|

Why does research show women need to work 8 years longer than men? – 2024 Gender Pension Parity ReportDo you ever dream about life after work? A time to explore new opportunities and have a bit more time to do the things you love. For some, the dream could be travelling the world or exploring new passions, for others it could simply be about spending more time with friends and family. Whatever the dream looks like, life after work should be something to look forward to for everyone. So why does new research show that women would need to keep working after their male colleagues retire to finish up with the same size pension pot1? A recent Gender Pension Parity Report reveals a 36% Gender Pension Gap2. Looking at this another way, it means that women would need to work an incredible 8 years longer to finish up with the same pension pot as men. |

What is the Gender Pension Gap?

As the number 1 provider of workplace benefits for Ireland’s employers and their workforce, a key part of Irish Life’s purpose is helping people, regardless of gender, to build better financial futures. So, when it’s time to ditch the ‘9-5’, you can feel ready and excited to embrace everything that comes next. Having started the Irish Gender Pension Parity conversation back in 2019, we have now curated a new 2024 report, diving into the data of over 130,000 defined pension plan members, to examine the current status of the Gender Pension Gap. Our report looks at the causes of the gap and recommends a series of solutions to remedy it and achieve Gender Pension Parity for the women of Ireland. |

What causes the Gender Pension Gap? |

What else impacts Gender Pension Parity?The good news is there are no major differences in the ages that men and women begin saving to a pension, or the percentage amount they contribute10. However, our data found that men are significantly more proactive in some key areas of pension saving. For instance, men are 60% more likely to make single premium Additional Voluntary Contributions (AVCs)11 to their pension, and are also more proactive than women in utilising the digital tools available, such as the Irish Life Pension Portal and the Tax Calculator. This imbalance in proactivity backs up recent reports which highlight the confidence struggle that many women experience when it comes to pensions and finances12.  Our data also shows how impactful proactivity can be, with those who are making single or regular Additional Voluntary Contributions (AVCs)13 in line to achieve a 150% larger pension pot than those who don’t. The research additionally shows that people who have registered for the Pension Portal are likely to end up with 54% larger funds at retirement14. So, it’s clear that helping women to build their confidence in this space and become more proactive is crucial. Empowering women with the right information and supports cannot be underestimated when it comes to levelling the playing field so that everyone can be confident when it comes to understanding their status and knowing the best next steps to take to optimise their future financial wellbeing. |

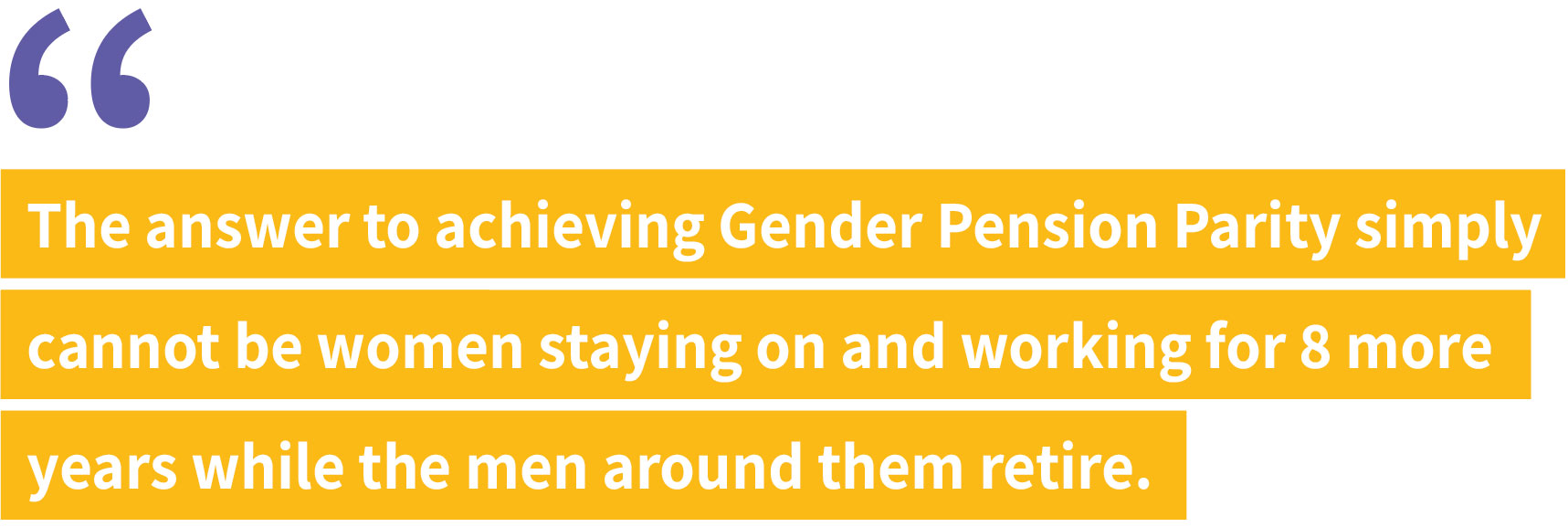

How can we achieve Gender Pension Parity?The current 36% Gender Pension Gap, combined with the fact that women live longer than men15 (meaning their smaller pension pot needs to sustain them for longer) means women are at a distinct disadvantage for life after work, with a recent OECD study reporting that women are 50% more likely to experience old age poverty than men16. However, the answer simply cannot be women working longer than men to build up the same pension pot.  At Irish Life, we are proposing solutions to level the playing field at three levels: Policy, Corporate and Individual. Pension policies need to be gender proofed to avoid baking in rules that exacerbate the gap, which has never been more important, with Auto Enrolment on the horizon. Companies need to review their own workplace policies and to offer gender specific educational supports with a focus on building financial confidence and economically empowering the women in our workplaces. And lastly, as individuals we all need to take every opportunity available to boost our own financial literacy, strengthen our knowledge and be confident that we understand the key things we can do to make the most of our money. Everyone has a part to play. Together, we can move towards achieving Gender Pension Parity for the women of Ireland. As always, at Irish Life, we are here to help! Reach out to us today to find out more. Read the full 2024 Gender Pension Parity Report now.  |

It’s important to point out that for the purpose of this report, we examine gender purely from a traditional ‘man’ or ‘woman’ perspective. Whilst it’s clear that the whole concept of gender is broader and more fluid than that, the data we use to glean the insights in this report differentiates only by men and women when it comes to gender at this time, though it’s clear that in the future, this debate will evolve. Our defined contribution (DC) group or workplace pension plans serve as our primary data source, with over 130,000 defined contribution plan members included in the data set, though we also gleaned some useful insights from initial outputs of an ongoing research study which Irish Life funded with South East Technological University around young women’s retirement planning in Ireland, which included both independent focus groups and substantial qualitative analysis. |

Sources1, 2, 4, 10Irish Life, October 2023 |